by Buse Dikici, Jai Khanna, Noah Wolford, Jasmin Stallzus

Fraud is relevant for many industries including banks, insurance companies, government agencies and more. It is a serious issue as it has increased drastically in the recent years and causes lots of money to be lost because of fraud every year. The definition of fraud is ‘’deception deliberately practiced in order to secure unfair or unlawful gain’’. Even though it is very difficult to detect threats, one can use big data technology to prevent fraud detection by distinguishing deceitful actions from ‘’normal’’ actions as well as identify schemes that is covered by data by gaining a whole image of the customers. One example of fraud is insurance fraud where there is a staged accident or false medical assumptions about a injury. That is where Big data analytics come in. It can look for patterns and identify similarities in historical claims which would help many companies to spend a huge amount of money on fraud and prevent to charge their customers with higher amount of money to make up for the lost money. In conclusion big data analytics is a huge benefit for companies that deal with fraud. It basically helps companies to identify and analyses false information and claims in minutes which would take days or even months without using the method.

Big Data and Data Science techniques and applications relevant to Security Fraud Detection

Typically, big data analytics tools and technologies combine text mining, machine learning and ontology modelling to ease security threat prediction, detection and prevention at an early stage. Big data and data science technologies now ease intelligence led investigation processes through improved collaboration and data analysis so that agencies can detect security threats easily.

Security firms now develop products that employ efficient data mining and data visualisation technologies to identify patterns from big data to understand the behaviour of spies, terrorists etc. For example, mail servers could use machine learning to understand and to filter emails from fraud banking sites that ask for user’s’ personal details and/or debit card and online banking PINs. One can train a machine to be suspicious of such activity by making it learn and identify from large amounts of previously collected data. Machine learning and predictive analytics work to pinpoint fraud red flags and proactively detect suspicious fraud schemes.

Also, with the rise of technologies like HADOOP and Spark, performing analytics on large data sets has become relatively easier.

Examples:

ACI Universal is a financial crime management organization, commonly used by financial organizations and retailers for fraud detection. By looking at big Data patterns of account transactions, they try to protect their customers from financial frauds. ACI Universal Payments is supporting with their services more than 5100 organizations, of which 1000 include some of the world’s largest financial organizations. Its customers include HyperPay, an online payment service and SWIFT, which is a messaging service for financial institutions.

SAS Fraud Management offers real-time scoring by looking at all their customer’s transactions. This big data analysis technique enables them to detect frauds more accurately and faster. Due to its advanced and efficient technology SAS Fraud Management is widely used among financial institutions. Its customers include the HSBC Bank, which with 46 million customers is the largest banking organization in the World. By using SAS Fraud Management, “HSBC significantly lowered incidence of fraud across tens of millions of debit and credit card accounts” (“Reduce losses from fraudulent transactions”, n.d.) globally.

Challenges:

Of the many challenges that the fraud detection and security industry faces, one of the largest continues to be user culture. There is almost universal support for individuals to use multiple unique passwords to protect their financial and personal information, but these habits have not been widely adopted by consumers. Businesses can invest in advanced encryption services to protect their users but if the same information is used on multiple websites, then the user’s information is as easily accessible as the weakest security system; a chain is only as strong as its weakest link. As soon as one online service is infiltrated, all of that user’s online information is at risk of being stolen.

Another issue that presents a challenge to fraud detection agencies is the increasing number of CNP (card not present) transactions. Fraud detection providers can use IP addresses and other location identifiers to attempt to block identity and card theft, but online criminals are continuously developing new techniques to evade these tactics. However, while the number of fraudulent CNP transactions has increased over the past decade, the percentage of these fraudulent transactions has not. Fraudulent transactions still comprise less than 1% of all total CNP transactions.

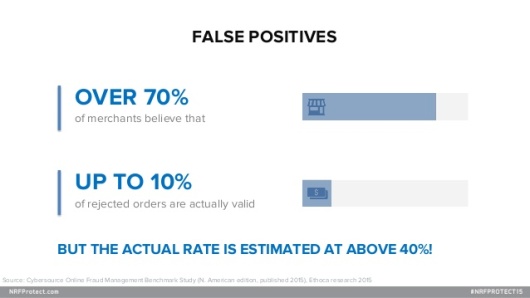

One of the more repairable but still pervasive problems in the fraud detection industry are false positives. These are transactions that are declined because they are suspected of being fraudulent but in reality, are completely valid purchases. This can be a frustrating problem for affected consumers to cope with and can very easily result in lost business. This problem becomes increasingly pressing when you consider that over 40% of transactions deemed fraudulent are actually false positives. However, as more advances are made in verification systems, this value is expected to decrease.

References:

About Us. (n.d.). SWIFT The Global Provider of Secure Messaging Services. Retrieved from https://www.swift.com/about-us

ACI Universal Payments [Digital image]. (n.d.). Retrieved from http://www.ir.com/img/aci-logo-universal.png

Fraud Detection and AML. (n.d.). ACI Universal Payments. Retrieved from https://www.aciworldwide.com/capabilities/fraud-detection-and-aml

Our Purpose. (n.d.). HSBC. Retrieved from http://www.hsbc.com/about-hsbc/our-purpose?WT.ac=HGHQ_f1.2_On

Press Releases. (n.d.). ACI Universal Payments. Retrieved from https://www.aciworldwide.com/news-and-events/press-releases

Real-time scoring of all transactions for fast, accurate fraud detection. SAS Fraud Management PRODUCT BRIEF. (2015). Retrieved from https://www.sas.com/content/dam/SAS/en_us/doc/productbrief/sas-fraud-management-102302.pdf

Reduce losses from fraudulent transactions. (n.d.). SAS The Power to Know. Retrieved from http://www.sas.com/en_us/customers/HSBC.html

SAS Fraud Management Detect and prevent fraud across the enterprise. (n.d.). SAS The Power to Know. Retrieved from http://www.sas.com/en_us/industry/banking/fraud-management.html

SAS The Power to Know [Digital image]. (n.d.). Retrieved from http://mms.businesswire.com/bwapps/mediaserver/ViewMedia?mgid=71191&vid=5

How can I use big data analytics in Fraud Detection?. Ikanow Editorial. Retrieved from

https://ikanow.com/how-can-i-use-big-data-analytics-for-fraud-detection/

Fraud Detection. [Digital image]. Retrieved from

http://images.wisegeek.com/fraud-with-blurred-numbers.jpg

Big data analytics: What it is and why it matters. SAS The Power to Know. Retrieved from

http://www.sas.com/en_us/insights/analytics/big-data-analytics.html

Big Data and Data Science for Security and Fraud Detection. Retrieved from

http://www.kdnuggets.com/2015/12/big-data-science-security-fraud-detection.html

It is funny because I don’t think financial security is improving, but rather that is keep pace with the growth of new forms of finance. Yes, credit card companies maybe much better detecting fraudulent charges, but at same time people are also exposing themselves to more risk. We always handing out our information for online shopping or other forms commerce. Even worse, unlike when you have your wallet stolen, when you information is compromised you are often completely unaware.

Just a thought 🙂

LikeLike